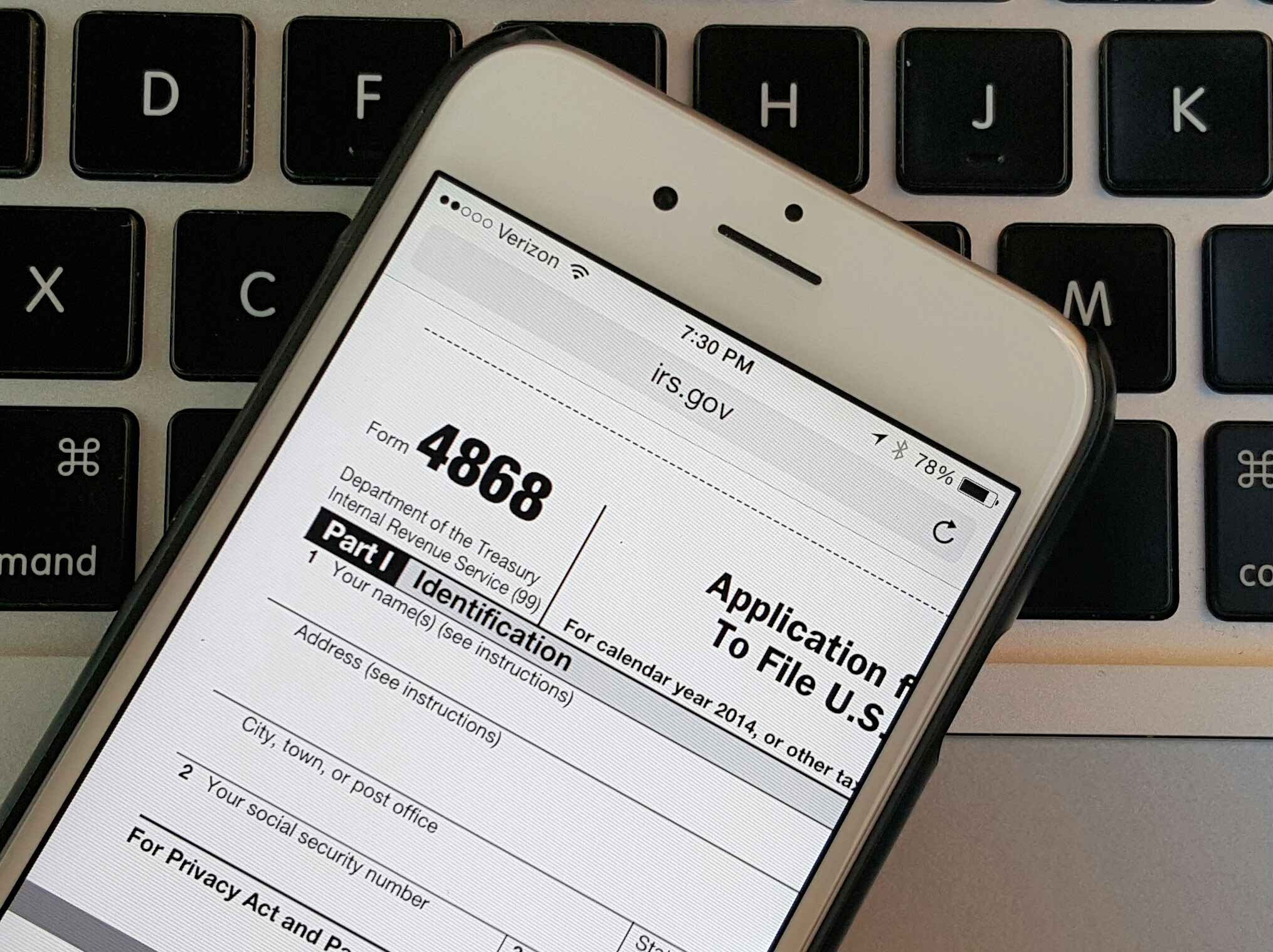

I understand once I complete my 2016 taxes I am required to update my 2018-2019 FAFSA using. The interest and penalties will seem like nothing compared to the late filing penalties. I have provided Form 4868 to the Student Financial Services Office. The final point I'd like to emphasize is that you should always file your return on time, or request an extension, even if you don't have the money to pay. To be perfectly clear, a tax extension gives you more time to file your return, but not to pay your taxes. In the previous example of a $1,000 balance that's a year late, you would owe $30 in interest and $60 in penalties, unless you get it waived. need to file Form 4868 if you make a payment using our electronic payment options. For more details, go to IRS.gov and click on. Unlike interest, the late payment penalty can be waived if you can show good cause for not paying on time. Several companies offer free e-filing of Form 4868 through the Free File program. The late payment penalty is assessed in addition to interest and is 0.5% of any unpaid tax for each month or partial month it remains unpaid, up to a maximum of 25%. The form is available through independent tax.

So, if you owe $1,000 and pay a year after the deadline, you'll owe $30 in interest. Individuals can submit Form 4868 to the IRS if they need an extension beyond July 15 to October 15, 2020. The IRS's interest rate can vary, and is 3% for underpayments as of the first quarter of 2016.

You will owe interest on any tax not paid by the normal due date, even if you have a legitimate reason for not paying on time - such as being out of the country or some other hardship.

0 kommentar(er)

0 kommentar(er)